Thursday, September 22, 2016

Friday, September 16, 2016

The Death Star

One of my favorite ways to kill time is to play some Star Wars Battlefront.

Game has been out for nearly a year now and it is still fun.

The Death Star is finally coming to the game next Tuesday and I am a bit excited.

Check out some gameplay footage if you'd like.

Game has been out for nearly a year now and it is still fun.

The Death Star is finally coming to the game next Tuesday and I am a bit excited.

Check out some gameplay footage if you'd like.

Tuesday, September 13, 2016

Updated Metals Pricing

Some quick charts on the metals pricing since August.

Things haven't been good of late. Down in the after markets after London closed too which doesn't show in these charts.

Things haven't been good of late. Down in the after markets after London closed too which doesn't show in these charts.

Sunday, September 11, 2016

Piece of Metal Falls From Hillary's Pants: White House Silverware Found?

Probably not the White House Silverware, she stole that over a decade ago.

Hillary Clinton Medical Issue at 9/11 Ceremony

Hillary had a major fainting spell today.

She left the 9/11 ceremony early and as a result her motorcade wasn't ready so she had to wait.

While waiting and propped up on a pillar, she appears to go limp and is dragged into her Sercret Service vehicle.

Check out her feet in particular, you can see she is being drug into the car.

She left the 9/11 ceremony early and as a result her motorcade wasn't ready so she had to wait.

While waiting and propped up on a pillar, she appears to go limp and is dragged into her Sercret Service vehicle.

Check out her feet in particular, you can see she is being drug into the car.

Friday, September 9, 2016

Bad Day for the Metals

Both gold and silver were down today and have continued down in the after market.

Looking at silver around $19.05 and gold at around $1326 at the moment.

Wednesday, September 7, 2016

Happy Birthday Emperor Vitellius

Roman Emperor Vitellius was born today September 7th in the year 15 AD.

Vitellius was only emperor for 8 months in the year 69 AD.

Interestingly he was the third of four men to be Emperor of Rome in 69 AD in the Year of Four Emperors.

After Emperor Nero committed suicide in 68 AD we had Galba and Otho and then Vitellius. He reigned for 8 months and realized that his military were going to remove him in typical Roman fashion and install their military leader Vespasian.

Vitellius had decided to abdicate his position but the soldiers killed him on 12.22.69AD. Vespasian took the job then and held it for a decade.

Here is a nice Vitellius silver denarius from his rule.

Vitellius was only emperor for 8 months in the year 69 AD.

Interestingly he was the third of four men to be Emperor of Rome in 69 AD in the Year of Four Emperors.

After Emperor Nero committed suicide in 68 AD we had Galba and Otho and then Vitellius. He reigned for 8 months and realized that his military were going to remove him in typical Roman fashion and install their military leader Vespasian.

Vitellius had decided to abdicate his position but the soldiers killed him on 12.22.69AD. Vespasian took the job then and held it for a decade.

Here is a nice Vitellius silver denarius from his rule.

Ref Vitellius Denarius, RIC 109, RSC 111, BMC 39

Vitellius AR denarius. A VITELLIVS GERM IMP AVG TR P, laureate head right / XV VIR SACR FAC Tripod, raven below, dolphin above. RSC111, BCM39.

This coin and image are from wildwinds.com. The go to website for matching ancient coins you are thinking about buying to known real coins. Check them out whenever you have an ancient coin issue to research. They are always linked here in the left hand column too if you forget the link.

Nice Price Action for the Precious Metals in September

Things are looking up for the metals this month anyway.

Here are charts for the past month.

Here are charts for the past month.

Nothing to write home about relative to August, but a nice start to the month is a nice start to the month.

2016 Standing Liberty Quarter Ounce Gold Coins Out Tomorrow at High Noon

Just a friendly reminder.

The 2016 Standing Liberty quarter ounce gold coins come out tomorrow at high noon, well high noon eastern standard time anyway.

These will probably sell out quickly as people look to buy them and flip them to collectors that miss out.

If you are interested in the coin, today is the day you should test out your US Mint account. Make sure you can log in. Make sure the payment information is up to date. All that stuff. Then it is just a matter of striking while the iron is hot tomorrow.

Good luck.

The 2016 Standing Liberty quarter ounce gold coins come out tomorrow at high noon, well high noon eastern standard time anyway.

These will probably sell out quickly as people look to buy them and flip them to collectors that miss out.

If you are interested in the coin, today is the day you should test out your US Mint account. Make sure you can log in. Make sure the payment information is up to date. All that stuff. Then it is just a matter of striking while the iron is hot tomorrow.

Good luck.

Tuesday, September 6, 2016

Big Gains for Precious Metals Today

Big gains for the metals today.

Silver cracked back above $20 and gold hit $1350 in the aftermarket after London closed.

Impressive day all around.

Here are the charts for London (the data source I use in Python for this). The markets have continued up since here.

Silver cracked back above $20 and gold hit $1350 in the aftermarket after London closed.

Impressive day all around.

Here are the charts for London (the data source I use in Python for this). The markets have continued up since here.

The Matrix Exposed

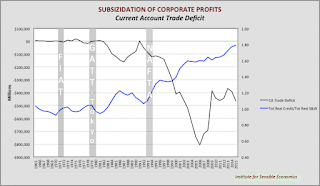

Fantastic article I wanted to share on printing money out of thin air and managed global trade.

The Matrix Exposed

Full article at the link.

Some teaser click bait to follow.

Now the subject of trade agreements always seems to elicit some very intense opposition to my own views. My claims have focused around the concept that so called Free Trade Agreements are anything but. These international trade agreements have two basic objectives. First is to create a cost arbitrage while negating the high risk proposition of undeveloped economies that naturally exists in a free market. Second is to protect the cost arbitrage from tariffs when targeting consumers back in developed economies. That’s really it. If you could lock those two objectives up on the back of a napkin the corporate interests would be happy for our legislators to sign it.

I’m about to prove that these trade agreements are the very essence of corporatism and together with fiat money have destroyed the natural self sustainment of capitalism through the requirement of private and public debt. In doing so corporatism has sabotaged the vast majority of American households thereby eradicating the capacity for economic growth. Leaving a tremendously precarious situation for those whose futures are not yet secured by fortune.

Note that labour cost arbitrage is not a real competitive advantage because it only works if government legislates away the naturally occurring free market risk. That is by definition, not a free market concept. So please, let’s stop calling these trade agreements ‘Free Trade’. And now think about a true capitalism cycle – Investment/production requiring profit, profit requiring consumption, consumption requiring income and income requiring investment – with only those parametres could firms profit if all firms implemented a labour cost arbitrage strategy?

And some charts too to back it up.

The Matrix Exposed

Full article at the link.

Some teaser click bait to follow.

Now the subject of trade agreements always seems to elicit some very intense opposition to my own views. My claims have focused around the concept that so called Free Trade Agreements are anything but. These international trade agreements have two basic objectives. First is to create a cost arbitrage while negating the high risk proposition of undeveloped economies that naturally exists in a free market. Second is to protect the cost arbitrage from tariffs when targeting consumers back in developed economies. That’s really it. If you could lock those two objectives up on the back of a napkin the corporate interests would be happy for our legislators to sign it.

I’m about to prove that these trade agreements are the very essence of corporatism and together with fiat money have destroyed the natural self sustainment of capitalism through the requirement of private and public debt. In doing so corporatism has sabotaged the vast majority of American households thereby eradicating the capacity for economic growth. Leaving a tremendously precarious situation for those whose futures are not yet secured by fortune.

Note that labour cost arbitrage is not a real competitive advantage because it only works if government legislates away the naturally occurring free market risk. That is by definition, not a free market concept. So please, let’s stop calling these trade agreements ‘Free Trade’. And now think about a true capitalism cycle – Investment/production requiring profit, profit requiring consumption, consumption requiring income and income requiring investment – with only those parametres could firms profit if all firms implemented a labour cost arbitrage strategy?

And some charts too to back it up.

Monday, September 5, 2016

Sunday, September 4, 2016

Saturday, September 3, 2016

NGC Certifies Hornets Nest Collection of Charlotte Mint Gold Coins

A coin type I do not own has made the news lately, well coin news anyway.

First ever full set of Charlotte gold assembled and graded by NGC.

CDN, aka the greysheet, has all the details, check it out.

http://blog.greysheet.com/2016/09/01/press-release-ngc-certifies-hornets-nest-collection-of-charlotte-mint-gold-coins/

Now for some eye candy.

First ever full set of Charlotte gold assembled and graded by NGC.

CDN, aka the greysheet, has all the details, check it out.

http://blog.greysheet.com/2016/09/01/press-release-ngc-certifies-hornets-nest-collection-of-charlotte-mint-gold-coins/

Now for some eye candy.

Today is the first full day of college football season. Very excited. My Buckeyes are taking on in state school Bowling Green. Not looking ahead to the Oklahoma game (against us in a few weeks, not later today against Houston which I am also looking forward to), but can't wait.

Also have my main league fantasy football draft today. Redraft league with 10 teams that I have been in for maybe 20 years or so, maybe more. Fun fact: Tom Brady and Devin Funchess are not on my draft board anywhere. Some turncoat Buckeye will draft them, that will not be me nor will it be my brother. Priorities.

Friday, September 2, 2016

Positive Start to September Metals Pricing

After a rough August, September is looking up for the metals.

Here are charts for the weekend from August until now.

Here are charts for the weekend from August until now.

Nothing to write home about so far in September, but at least the blood letting has stopped for now.

Wednesday, August 31, 2016

End of Month Year to Date Metals Pricing

End of month today so a quick look at the year to date metals pricing.

Both have performed great this year.

Will this recent down trend continue after breaking the long down trend of the past several years just this year?

Is this dip a buying opportunity?

Don't ask me, I just collect coins.

Very interested in the metals and the charts, but my psychic abilities are sadly limited at best.

Personally we haven't dropped enough yet from the July time frame highs for me to be concerned, but we are getting close.

Both have performed great this year.

The run up from January until July was fantastic.

August was a bloody month for anyone who got in on the trend late though.

Will this recent down trend continue after breaking the long down trend of the past several years just this year?

Is this dip a buying opportunity?

Don't ask me, I just collect coins.

Very interested in the metals and the charts, but my psychic abilities are sadly limited at best.

Personally we haven't dropped enough yet from the July time frame highs for me to be concerned, but we are getting close.

Tuesday, August 30, 2016

Gold and Silver Pricing Since the Nixon Shock

Some long term charts.

From the Nixon Shock where he closed the gold window August 15th 1971 until now.

Enjoy.

From the Nixon Shock where he closed the gold window August 15th 1971 until now.

Enjoy.

Monday, August 29, 2016

Heritage September Auctions: MS67 1924 St. Gaudens Double Eagle

Grab a cup of coffee and check out this gem Double Eagle $20 gold coin.

Common date gold coin with high mintage figures, but an uncommonly nice example here.

As of this writing there is only one known finer 1924 Double Eagle in the world.

Sunday, August 28, 2016

Long Beach, CA Show: Heritage Auctions

Big coin show coming up in September in Long Beach California.

Heritage will be running several key auctions for the hobby during the show.

First a few videos on the auctions and then some links to their coin auctions for the show.

And here are some links to the auction catalogs for those wanting to do either research or window shopping. Grab a coffee and a look at some fine coins about to hit the auction block.

2016 September 7 - 11 Long Beach Expo US Coins Signature Auction - Long Beach #1239

2016 September 8 - 13 Long Beach Expo World Coins & Ancient Coins Signature Auction - Long Beach #3049

2016 September 9 - 12 The Twelve Oaks Collection Signature Auction #1244

Heritage will be running several key auctions for the hobby during the show.

First a few videos on the auctions and then some links to their coin auctions for the show.

And here are some links to the auction catalogs for those wanting to do either research or window shopping. Grab a coffee and a look at some fine coins about to hit the auction block.

2016 September 7 - 11 Long Beach Expo US Coins Signature Auction - Long Beach #1239

2016 September 8 - 13 Long Beach Expo World Coins & Ancient Coins Signature Auction - Long Beach #3049

2016 September 9 - 12 The Twelve Oaks Collection Signature Auction #1244

Saturday, August 27, 2016

Take the PCGS Grading Challenge with CoinWeek

You can play along if you like in the video.

If you really like it, there is a phone number to call at the end of the video to register to play live in person at the Long Beach Show in September.

Anyway, on to the show for you. For me it is outside to mow.

If you really like it, there is a phone number to call at the end of the video to register to play live in person at the Long Beach Show in September.

Anyway, on to the show for you. For me it is outside to mow.

Friday, August 26, 2016

Updated Metals Pricing For the Weekend

Here are the month to date charts for silver and gold.

The down trend is looking real. Now is it a counter trend move and are we going to go back up, who knows. I'd just be careful at the moment putting any new money to work or letting any money you have plans for stay at work.

Thursday, August 25, 2016

Video: Heritage Auctions Long Beach Sept. 7-11

Just a quick video on the upcoming Heritage Signature US Coins Auction in Long Beach next month.

Check it out.

Check it out.

Wednesday, August 24, 2016

Trend Reversal or Correction?

A closer look at the charts shows a down trend since roughly the 10th or 11th of August.

First gold.

Now silver.

Neither chart is healthy since the 11th for sure. Now if you have bought recently after that large rip up through 18 and into the 20's, it might be time to think about cutting your losses as we are nearing correction territory (10%).

Longer term players like myself have been buying up the metal for some time now. Unless you bought on the way back down from $50 you should be up right now.

Silver seems to be breaking down more than gold too. Could be that the gold to silver ratio (GSR) was getting a bit out of whack and that is why, who knows.

Gold and silver are fairly flat now overnight, but it wouldn't surprise me at all to see them get whacked Thursday and Friday. Me, I am holding tight, but if I were forced to trade I'd sell here and not buy.

First gold.

Now silver.

Neither chart is healthy since the 11th for sure. Now if you have bought recently after that large rip up through 18 and into the 20's, it might be time to think about cutting your losses as we are nearing correction territory (10%).

Longer term players like myself have been buying up the metal for some time now. Unless you bought on the way back down from $50 you should be up right now.

Silver seems to be breaking down more than gold too. Could be that the gold to silver ratio (GSR) was getting a bit out of whack and that is why, who knows.

Gold and silver are fairly flat now overnight, but it wouldn't surprise me at all to see them get whacked Thursday and Friday. Me, I am holding tight, but if I were forced to trade I'd sell here and not buy.

Large Gap Between $19 and $18 Silver

We are well into the large gap up in silver.

Now there is a large drop in the silver chart threatening a nice run.

Will be interested to see if we test $18 flat here or if this is just a dip.

Here is the silver chart.

Now there is a large drop in the silver chart threatening a nice run.

Will be interested to see if we test $18 flat here or if this is just a dip.

Here is the silver chart.

Probably a decent amount of stop orders around $18 and just under. If that price does get probed, a good year's worth of gains could evaporate in an instant.

Stay frosty.

Tuesday, August 23, 2016

CoinWeek: 1974-D Aluminum Lincoln Cent

Another cool video I just found.

Grab a coffee and a look at a rarity in nice HD video.

Grab a coffee and a look at a rarity in nice HD video.

Monday, August 22, 2016

1937D 3 Legged Buffalo Nickel PCGS MS64+ CAC: More Window Shopping from Heritage September Auction

Just doing some more window shopping for the Heritage September Auction.

Check out this great 3 legged Buffalo Nickel.

Check out this great 3 legged Buffalo Nickel.

Monday Metals Meltdown

Precious metals took a big hit today.

Here are the charts for the month of August so far.

Both are showing a decline.

Is this trend reversal?

I wouldn't go that far yet, but it is certainly time to be cautious.

Anyways here are the charts.

Here are the charts for the month of August so far.

Both are showing a decline.

Is this trend reversal?

I wouldn't go that far yet, but it is certainly time to be cautious.

Anyways here are the charts.

Sunday, August 21, 2016

Friend the Federal Reserve on Facebook

Despite having the power to print money out of thin air, the Federal Reserve got bored recently.

What do bored people do, well they waste time of facebook.

So the Fed started up a facebook account and now their fans are reaching out to them.

Here is some from their first post.

Enjoy.

Saturday, August 20, 2016

Heritage Auctions Video: 1909 S VDB MS67 Red

Just a touch out of my budget, but I can window shop here on a lazy Saturday morning.

Friday, August 19, 2016

Weekend Metals Pricing

Here are the charts for gold and silver from June 1st till now.

Gold is showing some sideways chop. You can almost see a wedge of consolidation there in the late July through now phase.

Silver while still showing the same sideways chop as gold is starting to break down. Since late July we have been seeing lower highs and lower lows. Still range bound, but not encouraging. There is a large gap to fill down too if we do break down.

Anyway, enjoy the weekend. Almost football season. Can't wait.

Thursday, August 18, 2016

Classic US Gold Hitting Rock Bottom

Classic US Gold pieces in less than mint state have basically zero premium to them.

That isn't always the case.

The coin above ain't less than mint state either, that eye candy comes from probably the best gold dealer around Doug Winter.

We ain't talking that drool quality gold Doug sells, more common gold.

It is dirt cheap, well gold cheap anyway. Not much premium over metal at all.

Article from one of my favorite free magazines Numismatic News Express on the topic just today.

Numismatic News on Now the Time to Buy Gold

Right now your only downside is the metal price.

Fakes could be a downside too. Gotta watch for fakes.

Always weigh your coin and check the measurements.

Even that doesn't make it real.

Learn the coin and learn the fakes.

If you want to minimize the risk of fakes, buy slabbed coins. You can get MS61 - 63 coins for just a shade over melt. You get below MS and you are at melt even with the slab cost for the most part.

That isn't always the case.

The coin above ain't less than mint state either, that eye candy comes from probably the best gold dealer around Doug Winter.

We ain't talking that drool quality gold Doug sells, more common gold.

It is dirt cheap, well gold cheap anyway. Not much premium over metal at all.

Article from one of my favorite free magazines Numismatic News Express on the topic just today.

Numismatic News on Now the Time to Buy Gold

Couldn't agree more.The most active market on the bourse floor for dealers turned out to be collectible gold coins. The premium over melt value has just about vanished.These are the very same coins that in the panic buying of 2008 were bringing premiums of 30, 40 and 50 percent over gold melt value.The premium would not have disappeared had collectors or investors been avidly buying the pieces in recent weeks.If you want collectible U.S. gold, now is the time to buy and take advantage of the absence of the usual crowd.

Right now your only downside is the metal price.

Fakes could be a downside too. Gotta watch for fakes.

Always weigh your coin and check the measurements.

Even that doesn't make it real.

Learn the coin and learn the fakes.

If you want to minimize the risk of fakes, buy slabbed coins. You can get MS61 - 63 coins for just a shade over melt. You get below MS and you are at melt even with the slab cost for the most part.

Walk Through NGC Grading Video

Nice video from CoinWeek with a live NGC coin submission at a show.

Generally you should only use PCGS or NGC or maybe ANACS, but probably not ANACS without reason. Anyone else adds no value.

Me, I like NGC as they are the cheaper of the big two.

NGC is the leader in ancient coin certification too and that is something I collect myself.

Now many ancient collectors prefer their coins raw, myself included. That being said if I buy one slabbed, I keep it slabbed as I know it will aid in the resale value and speed come time to sell.

Anyway, check out the video for a look at the grading process.

Wednesday, August 17, 2016

Year to Date Metals Pricing

Just threw together some YTD charts for gold and silver and wanted to share.

Both charts are in a nice consolidation phase after price run ups this year.

Ideally it breaks up from here, which would be a great time to buy, and runs into 2017.

The longer we stay in this consolidation phase though the better, assuming a break for the positive of course still. . . .

Still having some trouble with the web scraper and database program.

Tried updating it by taking my old code and pasting together a new one, but ended up with a problem in one of the loops if not more. Going to have to just program it from scratch like the last one and make sure the data is handled properly.

That's one of the few faults of Python programming language. It is so easy you can just copy and paste your way to success in just a few hours after hearing about it. Easy to get in deeper than you realize before you can back out. Me, I am going to scrap the program I wrote and start over. No throwing good money (or time) at it. It is broke and I don't feel much like fixing it. Going to start over.

Tuesday, August 16, 2016

Ancient Silver Greek Coins Video

Another good ancient coin video. Another one that I collect personally, ancient Greek silver coins.

Monday, August 15, 2016

August 15th, the Day the Dollar Died

45 years ago today on August 15th 1971 the U.S. Dollar died.

It had been circling the grave for some time since the start of the Income Tax and Federal Reserve in 1913 and the tyrant Roosevelt's confiscation of gold and making gold non convertible for U.S. citizens in 1933.

What Nixon did 45 years ago was to 'temporarily' suspend the convertibility of the U.S. Dollar into gold. Now that dollar wasn't convertible into gold for American citizens, only foreigners. Nixon just shut the gold window down for foreigners.

At that point all the charts start to trend down.

At that point America started to trend down.

Now we don't necessarily have to return to a gold (or bimetallism) standard to fix this.

We have other options.

Instead of having a private central bank, you can nationalize the central bank and eliminate both the national debt and all taxes on U.S. citizens in one move.

I still prefer gold (and some form of minimal taxation if and only if we have a hard currency), but a nationalized central bank is a great improvement to a private central bank.

Not to go all conspiracy theory here, but I'd even prefer a global central bank with a global one world currency than the competitive devaluation game we get with every country having their own private central bank. Every country having their own nationalized central bank would be an improvement though and gold / bimetallism would be ideal in my world.

We don't get a choice though.

The cashless world with negative interest rates is coming.

We need to push back.

No more taxes on human beings until there is hard currency again.

It had been circling the grave for some time since the start of the Income Tax and Federal Reserve in 1913 and the tyrant Roosevelt's confiscation of gold and making gold non convertible for U.S. citizens in 1933.

What Nixon did 45 years ago was to 'temporarily' suspend the convertibility of the U.S. Dollar into gold. Now that dollar wasn't convertible into gold for American citizens, only foreigners. Nixon just shut the gold window down for foreigners.

At that point all the charts start to trend down.

At that point America started to trend down.

Now we don't necessarily have to return to a gold (or bimetallism) standard to fix this.

We have other options.

Instead of having a private central bank, you can nationalize the central bank and eliminate both the national debt and all taxes on U.S. citizens in one move.

I still prefer gold (and some form of minimal taxation if and only if we have a hard currency), but a nationalized central bank is a great improvement to a private central bank.

Not to go all conspiracy theory here, but I'd even prefer a global central bank with a global one world currency than the competitive devaluation game we get with every country having their own private central bank. Every country having their own nationalized central bank would be an improvement though and gold / bimetallism would be ideal in my world.

We don't get a choice though.

The cashless world with negative interest rates is coming.

We need to push back.

No more taxes on human beings until there is hard currency again.

Sunday, August 14, 2016

Coins of Alexander the Great

Can't vouch for the dealer but the coins he shows all look legit. The prices are crazy, but they are all take offers so it is expected.

Good video on the coins of Alexander the Great.

Good video on the coins of Alexander the Great.

Check out his youtube channel and his eBay store.

Again, I don't know the guy at all, but he produced a solid informative video.

Maybe he is worth getting to know, you know.

Weekend Metals Pricing

Been range bound in price since July.

Here are the charts showing that range.

First off we have gold.

Anyways just a quick metals update, not that there is anything worth updating.

Working on some modern mint issues like the Roosevelt and Kennedy special issues. Trying to rewrite the program to make it easier to extend to new parts but so far have just made it worse. Oh well. Maybe Sunday will get me there.

Here are the charts showing that range.

First off we have gold.

LBMA closes Friday and we have seen down since then into the $1330's. More sideways chop.

As for silver, same thing. LBMA again closes Friday and silver is down some since then into the $19.60's.

Anyways just a quick metals update, not that there is anything worth updating.

Working on some modern mint issues like the Roosevelt and Kennedy special issues. Trying to rewrite the program to make it easier to extend to new parts but so far have just made it worse. Oh well. Maybe Sunday will get me there.

Monday, August 8, 2016

Terms of surrender from a hard money guy for accepting a cashless fiat society (part 2)

In part one I decided it is best to have a position to negotiate to, not that we will have that power, but it is a nice fantasy anyway that our monetary masters will negotiate with us in good faith.

The first condition I laid out in part one was no taxes on human beings.

If you print the money out of thin air, the government's fair share of our money is zero. Why tax us when they can just print more anyway?

This is part two so time for the second condition.

Any new dollar is a new dollar.

Old dollars will convert to new dollars on a sliding scale, the longer you hold out the less your current dollars are worth. This works for debt too. We need to clear the debts.

Debt obligations in old dollars are not converted to new dollars, they can be paid back in depreciated old dollars which will eventually be worthless / free, effectively discharging all debt world wide after a transition period.

So that is condition two. Old dollars convert to new dollars on a sliding scale and no debts are converted to new dollars which basically results in a world wide debt jubilee by the end of the transition phase.

Give me that and condition one, no taxes on human beings and we are 90% of the way there.

Sounds like a deal breaker, but honestly we are letting those who print money out of thin air and have ruined the world economy keep their heads, their wealth, and their ability to print money out of thin air. Seems like a fair deal to me. They really aren't giving up anything and they are buying cheap life insurance at the same time. Win win.

The first condition I laid out in part one was no taxes on human beings.

If you print the money out of thin air, the government's fair share of our money is zero. Why tax us when they can just print more anyway?

This is part two so time for the second condition.

Any new dollar is a new dollar.

Old dollars will convert to new dollars on a sliding scale, the longer you hold out the less your current dollars are worth. This works for debt too. We need to clear the debts.

Debt obligations in old dollars are not converted to new dollars, they can be paid back in depreciated old dollars which will eventually be worthless / free, effectively discharging all debt world wide after a transition period.

So that is condition two. Old dollars convert to new dollars on a sliding scale and no debts are converted to new dollars which basically results in a world wide debt jubilee by the end of the transition phase.

Give me that and condition one, no taxes on human beings and we are 90% of the way there.

Sounds like a deal breaker, but honestly we are letting those who print money out of thin air and have ruined the world economy keep their heads, their wealth, and their ability to print money out of thin air. Seems like a fair deal to me. They really aren't giving up anything and they are buying cheap life insurance at the same time. Win win.

Sunday, August 7, 2016

Updated Metals Pricing

Here is where we left off Friday night.

Starting with the gold chart:

And finishing with the silver chart:

After the big run up in June, both metals fell and then rebounded. Look to be falling again, we will see about any rebound.

Looks like two cup patterns in both the gold and silver charts. Wouldn't mind seeing a handle form on the end of these cups with a small consolidation phase before grinding higher this fall.

Sunday, July 31, 2016

Terms of surrender from a hard money guy for accepting a cashless fiat society

The monetary system will change again, just like it did in 1971, 1946, 1933, and 1913.

The cashless society with awful negative rates is what they are pushing.

Guys like me and you are the push back. We like gold and silver not credit money.

There aren't many guys like me and you though so we should probably have some sort of fallback position to negotiate to if we are fortunate enough to get to negotiate the terms our monetary slavery with our monetary masters.

My thoughts are simple.

If the money is printed out of thin air, we don't need taxes on human beings any more.

The government's fair share of its citizen's money is zero, especially since they can just conjure up more money on demand and leave guys like me and you alone.

Think about it, if you had a magic machine that printed money out of thin air, why agitate the masses with taxes. Just print what you need and move on.

No taxes on human beings is condition number one for accepting a cashless society.

Taxes are a barbarous relic. Nothing more than a history of oppression really.

I am sure this will be the deal breaker, but we got the votes if Hillary doesn't steal them.

Besides, you can't make a valid argument in favor of taxes in either a fiat or cashless society. There is no need for taxation in a fiat system and their fair share really is zero percent.

Well, that is condition number one. I have others but lets work on this one first.

No taxes for human beings until we have hard currency again.

With elastic money there is no need to oppressively tax ourselves any longer.

The cashless society with awful negative rates is what they are pushing.

Guys like me and you are the push back. We like gold and silver not credit money.

There aren't many guys like me and you though so we should probably have some sort of fallback position to negotiate to if we are fortunate enough to get to negotiate the terms our monetary slavery with our monetary masters.

My thoughts are simple.

If the money is printed out of thin air, we don't need taxes on human beings any more.

The government's fair share of its citizen's money is zero, especially since they can just conjure up more money on demand and leave guys like me and you alone.

Think about it, if you had a magic machine that printed money out of thin air, why agitate the masses with taxes. Just print what you need and move on.

No taxes on human beings is condition number one for accepting a cashless society.

Taxes are a barbarous relic. Nothing more than a history of oppression really.

I am sure this will be the deal breaker, but we got the votes if Hillary doesn't steal them.

Besides, you can't make a valid argument in favor of taxes in either a fiat or cashless society. There is no need for taxation in a fiat system and their fair share really is zero percent.

Well, that is condition number one. I have others but lets work on this one first.

No taxes for human beings until we have hard currency again.

With elastic money there is no need to oppressively tax ourselves any longer.

End of Month Metals Pricing

July 2016 is over as far as the metals markets are concerned, time to check on the charts.

Gold was pretty range bound after a great first half of 2016. Gold started the month in the 1340's and ended there too. Trend is still up but this is sideways chop.

Pretty much the same thing with silver, range bound.

I'd still be cautious here, but the up trend remains. For how long it remains, who knows.

Gold was pretty range bound after a great first half of 2016. Gold started the month in the 1340's and ended there too. Trend is still up but this is sideways chop.

Pretty much the same thing with silver, range bound.

I'd still be cautious here, but the up trend remains. For how long it remains, who knows.

Wednesday, July 27, 2016

Sunday, July 24, 2016

Updated Pricing: Is the trend reversing?

Gold and silver have had a great year so far.

Here is the gold chart year to date.

The run up from February to March held and now we have had this breakout in June. It has peaked for the moment in July, where it goes from here is way above my pay grade. Who knows.

Wouldn't surprise me at at to see it test that $1280 - $1300 range again. If it breaks that, you could see it retrace even the February / March gains and get back to the $1100 range.

I don't see it, but I am not very psychic either so something to be on the lookout for.

I'd like to see gold test that round $1300 number and push back over $1350 or even $1400, that would be continuing the trend.

Silver is similar but different. Here is the silver chart year to date.

Silver has been more volatile and more profitable this year. Trend of the past week has been down. Will it continue? There isn't much inventory below this until we get back to $18 or so which is a significant drop from the $20 - $21 range we touched.

Again not psychic, but this recent downtrend seems temporary to me.

We still haven't plunged back into the giant gap up in early July.

Silver has had more strong up phases than gold so far this year so it is normal for gold to catch up some. I still have faith in silver and hold tight.

Here is the gold chart year to date.

The run up from February to March held and now we have had this breakout in June. It has peaked for the moment in July, where it goes from here is way above my pay grade. Who knows.

Wouldn't surprise me at at to see it test that $1280 - $1300 range again. If it breaks that, you could see it retrace even the February / March gains and get back to the $1100 range.

I don't see it, but I am not very psychic either so something to be on the lookout for.

I'd like to see gold test that round $1300 number and push back over $1350 or even $1400, that would be continuing the trend.

Silver is similar but different. Here is the silver chart year to date.

Silver has been more volatile and more profitable this year. Trend of the past week has been down. Will it continue? There isn't much inventory below this until we get back to $18 or so which is a significant drop from the $20 - $21 range we touched.

Again not psychic, but this recent downtrend seems temporary to me.

We still haven't plunged back into the giant gap up in early July.

Silver has had more strong up phases than gold so far this year so it is normal for gold to catch up some. I still have faith in silver and hold tight.

Sunday, July 17, 2016

Gold and Silver Pricing since June 1

Some quick charts I threw together after lunch today.

Price of gold and silver since June 1 charts to be exact.

Both have been very strong performers all year, but silver remains the stronger of the two as it should since we are coming off an 80+ GSR.

Was at a party yesterday and was given the advice to look into selling silver soon by a relative that is also a collector. Nothing wrong with taking a gain other than taxes, but nothing wrong in letting a winner win either. Me, I am letting my winners win.

Lots of people at the party were shocked to find out that silver is up so much this year so far.

Hopefully they haven't seen anything yet.

Price of gold and silver since June 1 charts to be exact.

Both have been very strong performers all year, but silver remains the stronger of the two as it should since we are coming off an 80+ GSR.

Was at a party yesterday and was given the advice to look into selling silver soon by a relative that is also a collector. Nothing wrong with taking a gain other than taxes, but nothing wrong in letting a winner win either. Me, I am letting my winners win.

Lots of people at the party were shocked to find out that silver is up so much this year so far.

Hopefully they haven't seen anything yet.

Monday, July 11, 2016

Year to Date Gold and Silver Charts

Just a quick update here Monday night with the gold and silver charts year to date.

Impressive moves on the whole.

Hopefully just the start of something too.

Silver in particular has been impressive trimming the gold to silver ratio (GSR) over 10 from a peak around 80. Generally 80 is a great time to swap gold for silver and those who did are sitting on some free ounces as a result.

Anyways here are the charts.

Impressive moves on the whole.

Hopefully just the start of something too.

Silver in particular has been impressive trimming the gold to silver ratio (GSR) over 10 from a peak around 80. Generally 80 is a great time to swap gold for silver and those who did are sitting on some free ounces as a result.

Anyways here are the charts.

Going to start another series of coin graphs here this week now that the Independence Day holiday is over and I am back to the routine. Going to do another modern coin series like the Ikes, but not really a series either.

We are going to look at the March of Dimes Roosevelt Silver Dimes as well as the special Kennedy Silver Halves. Whether or not those are part of your set or not is up to you. If you want them like I did though, this will give you a quick look at the prices on these coins in the market.

Probably going to break them into separate sets of charts and then maybe next time I look at them, add some key date Kennedy and Roosevelt coins and grow the data set. Not a lot of keys in either series though so probably more conditionally rare than anything. There isn't a lot of talk on the net about these coins so I'd like to help fill the gap some as they are some of my favorite recent mint releases.

Subscribe to:

Comments (Atom)